Thesis

There is an opportunity to acquire and invest in existing multifamily assets below replacement cost in markets out of favor with traditional institutional capital. During the great financial crisis we had strong success with a similar strategy and we see early evidence of a significant correction in pricing occurring again for existing assets in our target markets coupled with a decline in future new housing deliveries.

Market Opportunity

- Existing loans are maturing and adjusting:

Nationwide, 30% of multifamily loans are set to mature by 2026 (CoStar) and others will convert from low fixed rates to higher adjustable rates

- Low permit applications:

very low volume of permit applications indicate very few housing deliveries starting in mid-2025 for the foreseeable future.

- Long-term undersupply perists:

the City of Portland’s 2045 Housing Needs Analysis identified the need for 120,560 new housing units by 2045.

- Discounted pricing:

opportunity to acquire existing assets at discounted prices significantly below replacement cost during this low point in the cycle.

- Affordability:

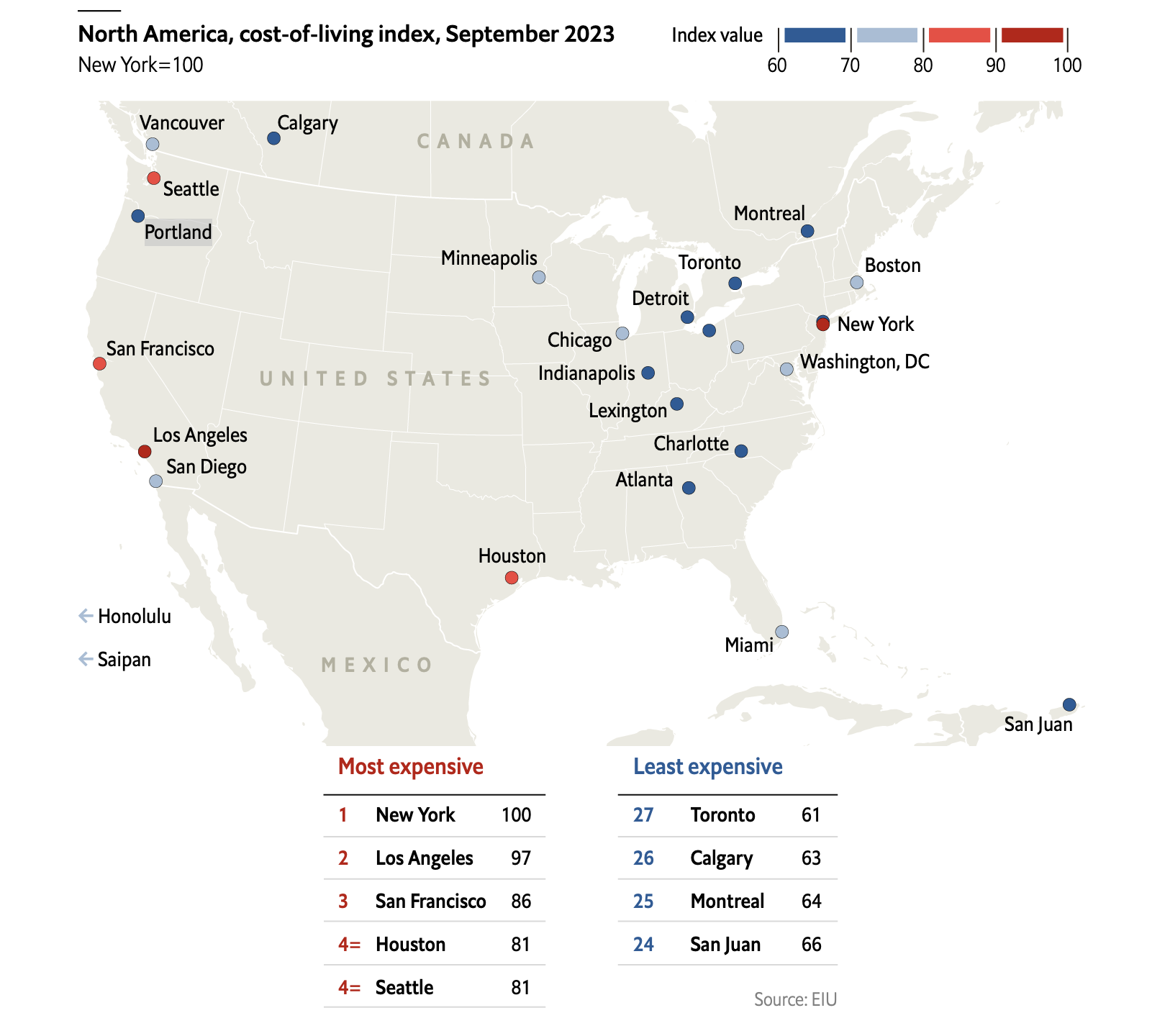

Despite the low volume of deliveries, attractive West Coast markets such as Portland and Sacramento have a distinct affordability advantage.

Offering Summary

Size: $10mm GP fund

Fund Fees: none

Profit Participation: 50% of UD+P promoted interest

Asset Fees: 25% of fees generated, shared with GP Fund

Acquisition: 2% of Cost

Asset Management: 2% of Gross Income

Property Management: 2-4% of Gross Income

Investment Criteria

Cash Flow: 6+% within 24 months

Yield on Cost: 6+%

Target Price: 20-30% below replacement-cost

Asset Type: Mixed-Use Multifamily

Target Hold: 5-7 years

Target Size: 50 to 100 units

Geography: Urban core, select suburban submarkets

Markets: Portland, Sacramento

Characteristics: < 10 years old or light renovation