UD+P News: January 2021

RENT COLLECTIONS UPDATE

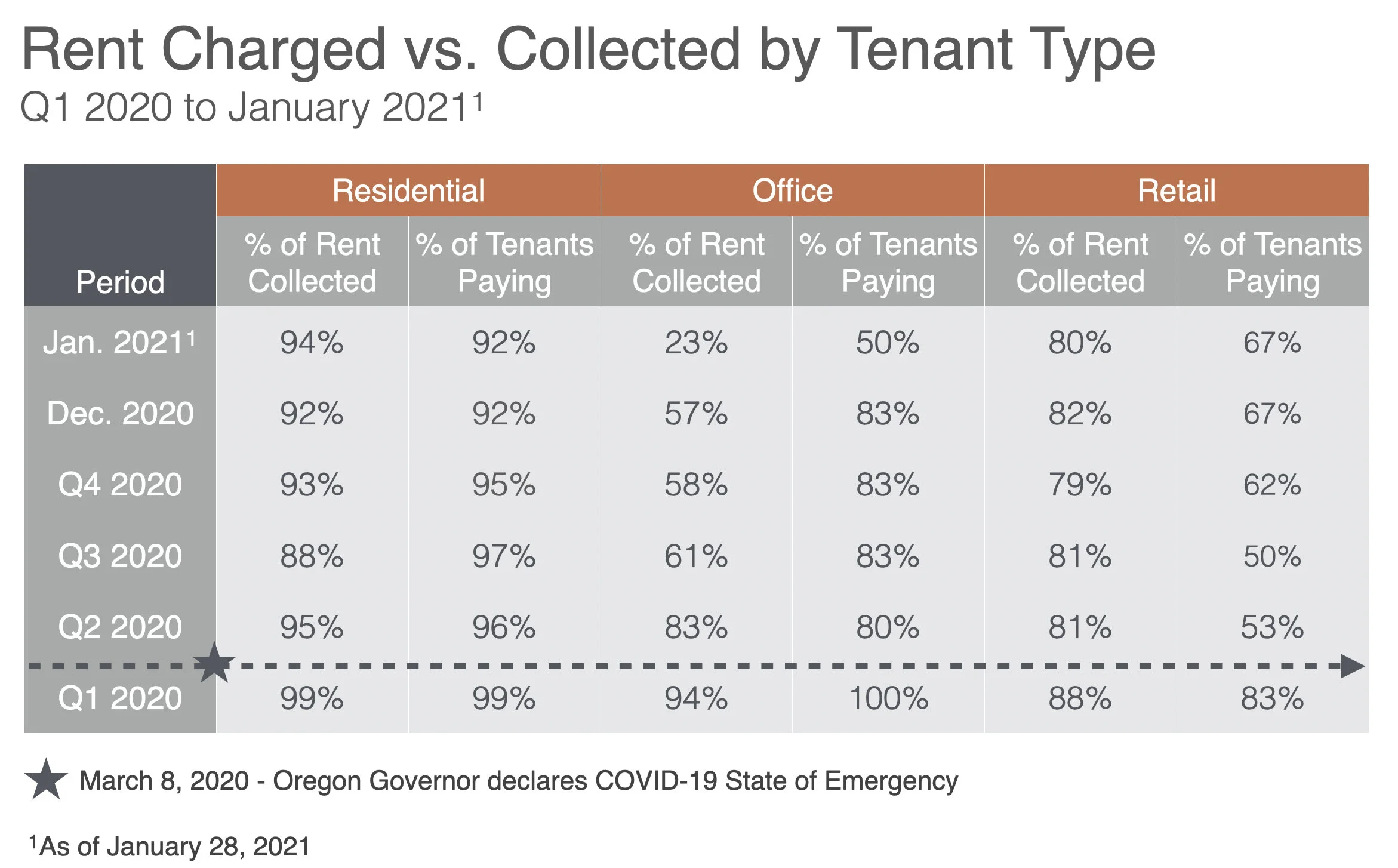

The table on the right summarizes rent charged versus rent collected by tenant type from Q1 2020 through January 2021 (as of 1/28/21). Quarterly rent collection data is provided for prior quarters, and monthly rent collection data is provided for the current quarter (Q1 2021). For the purpose of comparing month-over-month changes, December 2020 collection data is also provided.

In January, the percent of retail rent collected dipped slightly to 80%, compared to 82% in December, whereas the percent of tenants paying rent (67%) held steady. Among our office tenants, both the percent of rent collected (23%) and the percent of tenants paying (50%) fell in January. This decline is primarily attributed to Overland Warehouse tenant ReachNow, which has not yet paid its January rent.

Since early December, Oregon’s COVID-19 Risk and Protection Framework has restricted social and at-home gatherings and indoor business and recreational activity based on whether a county is designated low, moderate, high or extreme risk in the COVID-19 pandemic, based on recent infection rates. Currently, all Portland metro area counties remain within the “extreme risk” category, which prohibits indoor dining and limits retailers to 50% capacity.

In January, residential rent collections rose slightly to 94%, compared to 92% in December. There was no movement in the percent of residents paying rent (92%). As of January 28, a total of 16 renter households are past due on their current month’s rent. Five of these households are behind on rent by one month or less. Eleven carry balances spanning multiple months, including four households owing three to five months of back rent and four households owing more than six months of back rent. Portland renters are currently protected by three residential eviction moratoriums in effect at the state, local and federal levels. Both Oregon’s statewide eviction moratorium and Multnomah County’s eviction moratorium will remain in effect through June 30, 2021. On January 21, President Biden issued an executive order extending the Center for Disease Control’s residential eviction moratorium, which had been set to expire on January 31, 2021. The CDC moratorium will now remain in effect through at least March 31, 2021. Regulations set forth in these moratoriums limit our capacity to inquire with residents about outstanding balances.

Our Operations team has been tracking the State of Oregon’s Landlord Compensation Fund. We have gathered the documentation required to apply for rent assistance when the Fund’s application portal launches in February. Landlords may receive a payment for 80% of rent in arrears in exchange for forgiving the remaining 20% of past due rent. The first round of funding will target back rent owed from April 2020 to February 2021.

RESIDENTIAL LEASING UPDATE

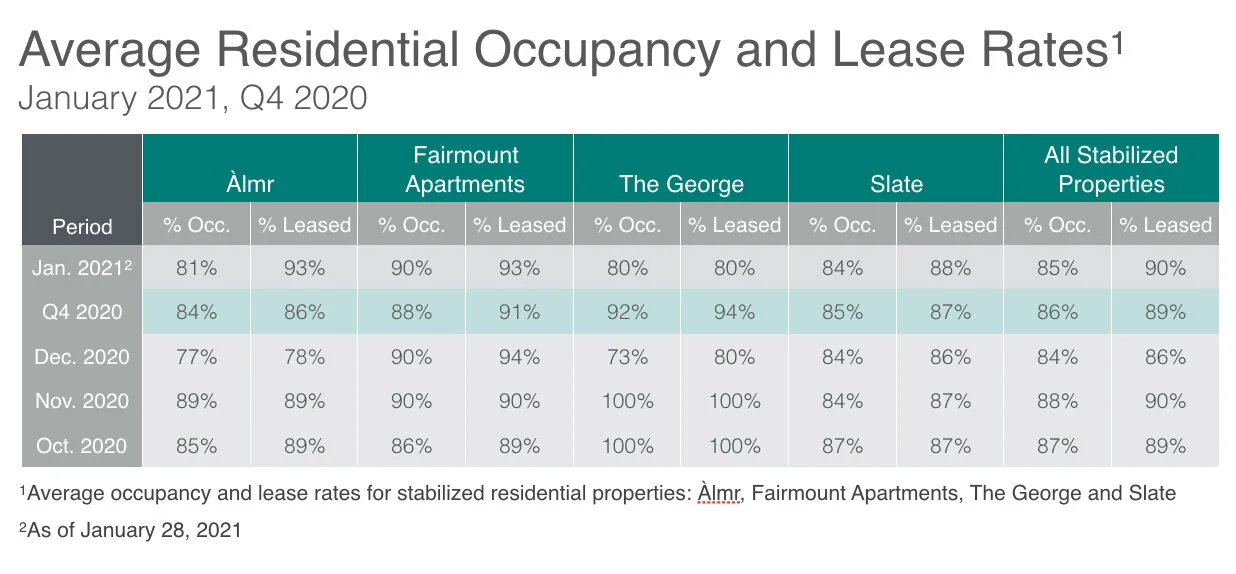

The table below shows average monthly residential occupancy and lease rates for individual properties, as well as portfolio-wide averages across all stabilized properties. In January, the portfolio-wide average occupancy rate was 85%—slightly higher than December (84%) and slightly lower than the fourth quarter average (86%). After a slowdown during the holidays, leasing activity has picked up during the New Year. The portfolio-wide average lease rate increased to 90% in January, up markedly from 86% in December, and up one percent from the fourth quarter average (89%). Notably, after dropping to below 80% in December due to several pandemic-related lease breaks and move-outs, Àlmr’s average lease rate recovered to 93% in January.

To attract prospective tenants and differentiate our properties from competitors, we are currently offering four weeks of free rent for new long-term leases of one year at Àlmr, Flanders and Slate. We are not offering concessions at Fairmount due to its consistently high lease rates during the past couple of months. At all of our properties, we have instituted a “zero deposit” at move-in policy, which has been well received by prospective residents and has helped us secure new leases.

We are actively marketing vacant units at Lyra and Cassi, sister properties in lease-up in Northeast Portland. Similar to our stabilized properties, we are offering four weeks of free rent and a “zero deposit” for new long-term leases. At Lyra, 41% of units are now leased. At Cassi, eight units are leased and six are currently available for rent. We will bring additional units to market as we complete maintenance, repairs and turns.

550 SE MLK - NEW DESIGN RENDERINGS

We are pleased to announce that GBD Architects recently completed the schematic design for 550 SE MLK. A sampling of the latest project renderings is provided below.

2020 TAX REPORTING INFORMATION

As the April 15 tax filing deadline draws closer, our accounting team is working diligently to prepare tax reporting documents. The estimated delivery date for Schedule K-1 tax documents for all UD+P funds is mid-March. Our tax accountant, Geffen Mesher, is closely monitoring state and federal tax laws. If any delays are anticipated due to new filing requirements or pandemic-related slowdowns, we will provide advance notice to members.

The Oregon Department of Revenue (ODR) requires pass-through entities to obtain a nonresident affidavit from nonresident owners if total Oregon-source distributive income is projected to exceed $1,000 during the tax year. In 2020, ODR announced it will now accept electronic signatures. During the coming month, we will contact out-of-state investors to obtain required nonresident affidavits electronically via DocuSign.

Lastly, we are required to obtain a disregarded entity disclosure from members that are invested through an entity (i.e., trust, LLC, corporation and other business entities). Last year, we obtained the disclosure from members who invested with UD+P in 2019 and years prior. We will be requesting the disclosure from “first-time” investors who subscribed to Urban Opportunity Fund I and Tabor IV in 2020.

If you have questions about 2020 taxes, please contact Investor Communications Manager, Tina McNerthney, by email or by phone at (503) 318-6588.