UD+P News: June 2022

PROJECT UPDATES

1201 J STREET - SACRAMENTO, CA

DOWNTOWN

Loyal Legion received its liquor license in June and will open on July 6th.

Loyal Legion, opening in July at 1201 J Street, will offer an extensive selection of beers on tap.

550 SE MLK - PORTLAND, OR

CENTRAL EASTSIDE

Due to a longer than anticipated wait time for building permits, 550 SE MLK’s construction start has been delayed until July. We expect to obtain permits and close on the loan in early July and we will commence construction in mid to late July.

HOTEL GRAND STARK - PORTLAND, OR

CENTRAL EASTSIDE

In June, Hotel Grand Stark was recognized by TripSavvy as Portland’s best boutique hotel. TripSavvy has a reach of 6.7 million monthly visitors.

550 SE MLK will break ground in July.

More than a year after opening in spring 2021, Hotel Grand Stark continues to garner recognition as one of Portland’s top boutique hotels.

THE GEORGE - PORTLAND, OR

NORTHWEST PORTLAND

Following the completion of waterproofing repairs at The George in April, our Operations team staged one of the vacant residential units that had been kept off line during repairs and obtained professional photos to refresh our digital marketing campaign. While only 80% of residences were leased at the start of June, The George is fully leased as we close out the month. New leases executed in June commanded high rents—one unit achieved a gross rent increased of 29%.

SLATE - PORTLAND, OR

CENTRAL EASTSIDE

As reported in our May newsletter, our Operations team staged a vacant 2-bedroom unit as Slate and had professional photos taken to support residential leasing. According to our residential property manager, Lisa Wehse, the updated images and marketing campaign are paying off. The majority of applicants are relocating to Portland for work from out-of-state and applying “site unseen”. After dipping below 90% for most of Q2 2022, the percent of homes leased at Slate shot up to 94.66% at the end of June. We signed 6 new leases in June, including three 2-bedroom leases, which have been more challenging to lease due to limited on-site parking availability.

Check out the slideshow below to view the new Slate images.

RESIDENTIAL LEASING UPDATE

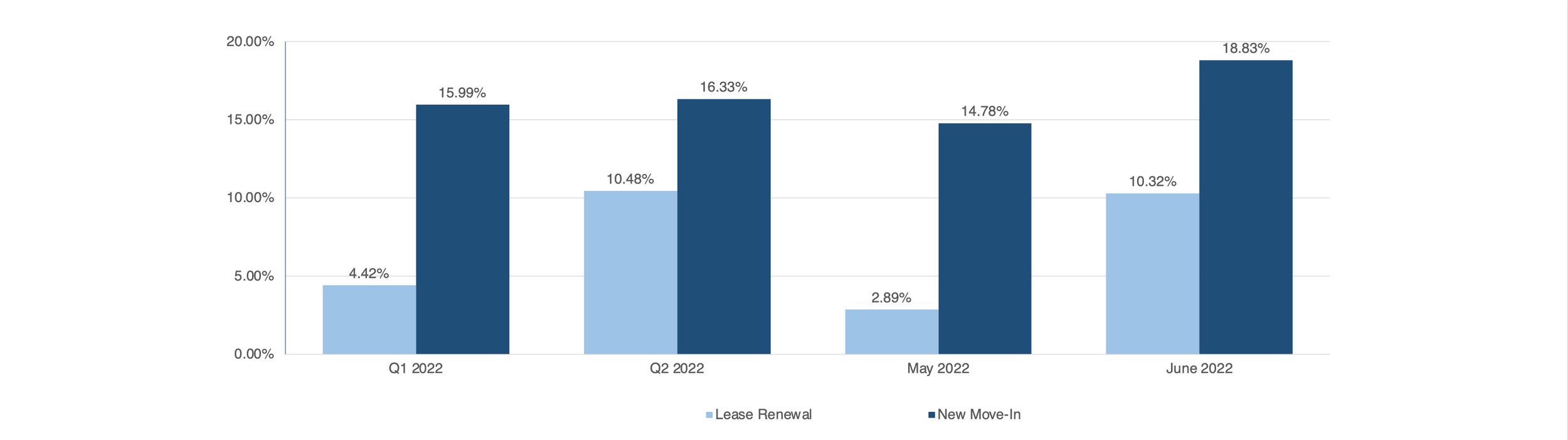

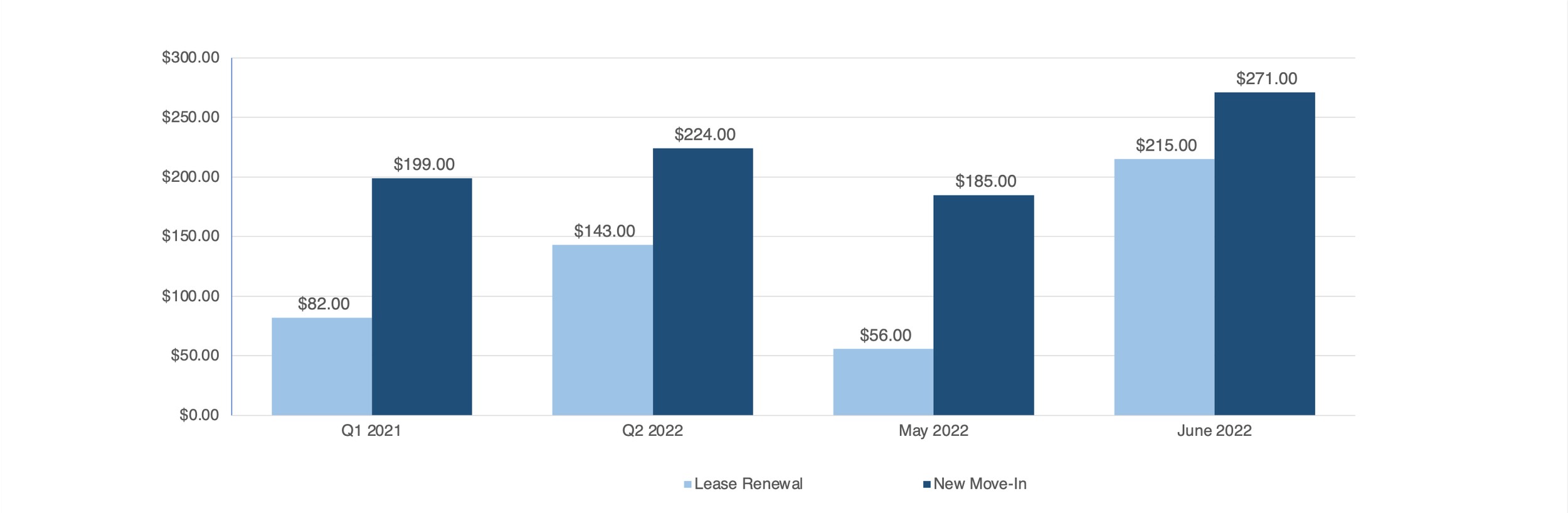

As summer begins, residential leasing activity remains brisk. Recent updates to our marketing campaigns on Apartments.com have led to an uptick in inquiries. In June, we received 19 lease applications, executed 16 new leases, and assisted with 15 new resident move-ins. We achieved outstanding rent growth on new leases executed in June and throughout Q2 2022. As shown in the tables below, lease turnover (LTO) yielded average rent growth of 18.83% ($271) in June, up from 14.78% ($185) in May. In Q2 2022, average LTO rent growth was 16.33% ($224), up slightly from 15.94% ($199) in Q1 2022. The past three quarters of double-digit rent increases on new leases was preceded by a 12- to 16-month period of depressed rental rates early in the pandemic. During this period from March 2020 to July 2021, rent concessions contributed to lower effective rents. Now that effective rental rates have recovered and surpassed pre-pandemic rents, our Operations team anticipates that we will begin to see less dramatic rent growth in future quarters.

We executed 13 lease renewals in June. June renewals yielded average rent growth of 16.24% ($215)—significantly higher than average renewal rent growth of 2.89% ($56) in May. In Q2 2022, average renewal rent growth was 10.84% ($143), compared to 5.94% ($82) in Q1. We typically aim for 4 to 6% gross rent increases on renewals. In June and throughout Q2, a number of leases signed in the spring and summer of 2021 with deeper rent concessions (e.g. 8 weeks free rent) came up for renewal. These concessions lowered the effective rents of the units. Therefore, although we capped “actual rent” increases at 6%, the gross rent increase realized on units with previously discounted rents exceeded 6%. By August 2021, our Operations team had eliminated or significantly scaled back rent concessions as the market began to recover. Accordingly, moving forward, rent growth attributed to renewals is anticipated to return to the more typical 4 to 6% range.

Lease Turnover and Renewal - Average Rent Growth ($)

The table below shows the percent of units leased at individual properties and portfolio-wide, across all stabilized properties.

PErCENT OF UNITS LEASED - STABILIZED RESIDENTIAL PROPERTIES

Across our residential portfolio, the percent of units leased averaged 96% in June, compared to 95% in Q1 and Q2 2022. At individual properties, the percent of units leased in June ranged from a low of 91% at Slate to a high of 100% at Àlmr and Lyra. Lease rates have been relatively stable for the past two quarters, with the exception of The George, where lease rates have improved dramatically since the completion of waterproofing repairs in April. As detailed in the Project Updates section, we’re also seeing some positive momentum at Slate, where the average lease rate rose to 91% in June and is on an upward trend.

We had fewer lease breaks in June relative to April and May. Continuing trends we’ve observed throughout the second quarter, most residents who are moving out are relocating out-of-area for work or moving in with a partner or roommate to reduce housing costs. We’ve seen an influx of applicants from out-of-state who are relocating to Portland for work at larger employers.

SAVE THE DATE: UD+P Annual MEMBER MEETING

If you haven’t registered for our Annual Meeting in October yet, please take a moment to learn more and “save the date” on your calendar.

DETAILS

WHEN: October 12, 2022 - 12:00 PM PST

OVERVIEW: Urban Development + Partners 2022 Annual Member Meeting will be a virtual event. Our presentation will include a fund performance overview, market update, development update and investment strategy discussion, followed by a Q & A. Presenters will include UD+P Principal, Eric Cress, Chief Operating Officer, Sarah Zahn, Portfolio Director, Julia Albano and V.P. of Investor Relations, Theresa Nute. Contact Tina McNerthney at tina@udplp.com or (503) 318-6588 for more information.