UD+P News: May 2022

SAVE THE DATE: UD+P Annual MEMBER MEETING

DETAILS

WHEN: October 12, 2022 - 12:00 PM PST

OVERVIEW: Urban Development + Partners 2022 Annual Member Meeting will be a virtual event. Our presentation will include a fund performance overview, market update, development update and investment strategy discussion, followed by a Q & A. Presenters will include UD+P Principal, Eric Cress, Chief Operating Officer, Sarah Zahn, Portfolio Director, Julia Albano and V.P. of Investor Relations, Theresa Nute. Contact Tina McNerthney at tina@udplp.com or (503) 318-6588 for more information.

PROJECT UPDATES

1201 J STREET - SACRAMENTO, CA

DOWNTOWN

May 10th marked the grand opening of the Aurora rooftop event space at 1201 J Street. Many, including UD+P team members Sarah Zahn and Danny Milman, turned out to celebrate and the event was a tremendous success. Check out Aurora’s website to learn more about this exciting new venue and view more images of the space.

Loyal Legion’s opening has been delayed until June due to a longer than anticipated release time for its liquor license.

Aurora event space at 1201 J Street, Sacramento - Grand Opening celebration

Aurora operations managers Jennifer Robards and Morgan Thompson (1st and 2nd from left) and UD+P Team members Danny Milman and Sarah Zahn (3rd and 4th from left) joined for a photo app at Aurora’s grand opening event on May 10.

Buildout of the Aurora rooftop event space in downtown Sacramento was completed in early May.

550 SE MLK - PORTLAND, OR

CENTRAL EASTSIDE

June is poised to be a busy month for 550 SE MLK. We are on track to obtain final building permits, close on our loan and kick off construction by the end of the month.

Construction will begin on 550 SE MLK in June.

HOTEL GRAND STARK - PORTLAND, OR

CENTRAL EASTSIDE

Hotel Grand Stark celebrated its one year anniversary in May and continues to impress—garnering great reviews and press. This spring, the hotel has been featured in several prominent publications.

A list of recent accolades and awards is highlighted below.

Hotel Grand Stark has been recognized as one of the best hotels in the U.S. and internationally by popular travel publications and sites, including Travel and Leisure, Sunset Magazine and Trip Advisor.

RESIDENTIAL LEASING UPDATE

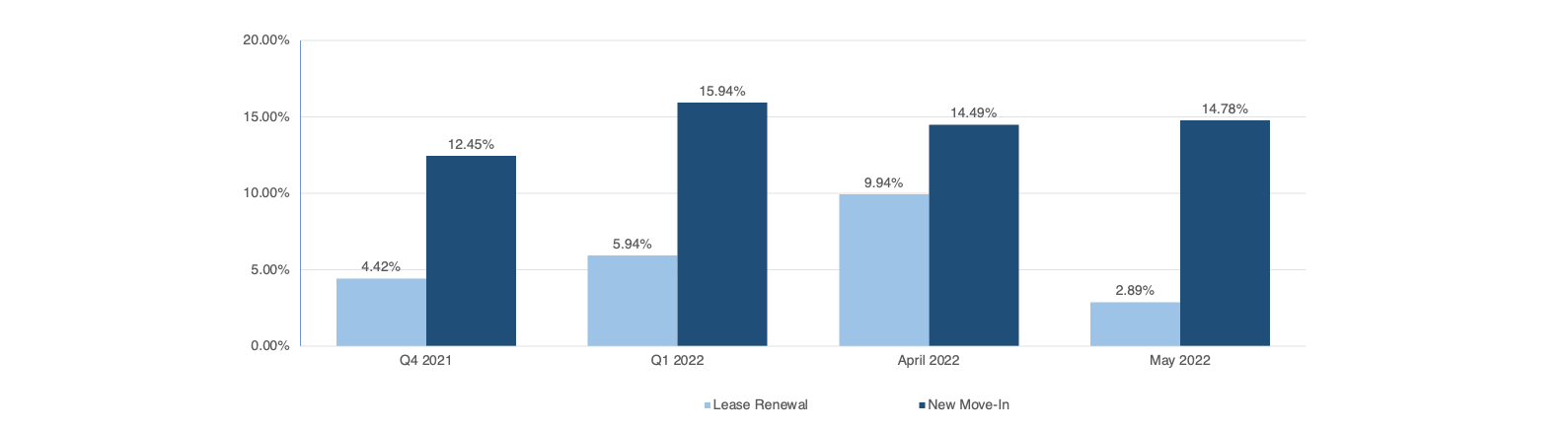

With spring in full swing, UDP’s residential leasing team is busy! In May, we received 26 lease applications, executed 24 new leases, and assisted with 18 new resident move-ins. Since the start of the second quarter, rent growth on new leases continues to be robust. As shown in the tables below, lease turnover (LTO) yielded average rent growth of 14.49% in April and 14.78% in May. This translates to an average rent increase of $214 in April and $185.00 in May for new move-ins.

We executed 12 lease renewals in April and nine in May. April renewals yielded average rent growth of 9.94% ($130)—significantly higher than average rent growth of 5.94% ($82) in Q1 2022. In May, however, average rent growth on lease renewals dipped to 2.89% ($56). The most significant factor that attributed to more subdued rent growth in May was a higher proportion of 2-bedrooms units up for renewal. Two-bedroom units typically do not capture as much rent growth as studios and 1-bedrooms, which are the most sought after unit types. Further, as we have reported on in past newsletters, leasing 2-bedroom units at Slate has proven challenging due to the lack of available secured on-site parking. In May, two of the nine renewals were 2-bedrooms at Slate that achieved rent growth ranging from 0 to 1%. In contrast, at Fairmount, Àlmr, Cassi and The George, we renewed five leases and achieved averaged rent growth of 4.8%. Lastly, at Lyra, we did not increase the rent for the renewal of an income-restricted studio apartment—one of eight affordable units designated for households earning up to 60% of Portland’s Median Family Income.

Lease Turnover and Renewal - Average Rent Growth ($)

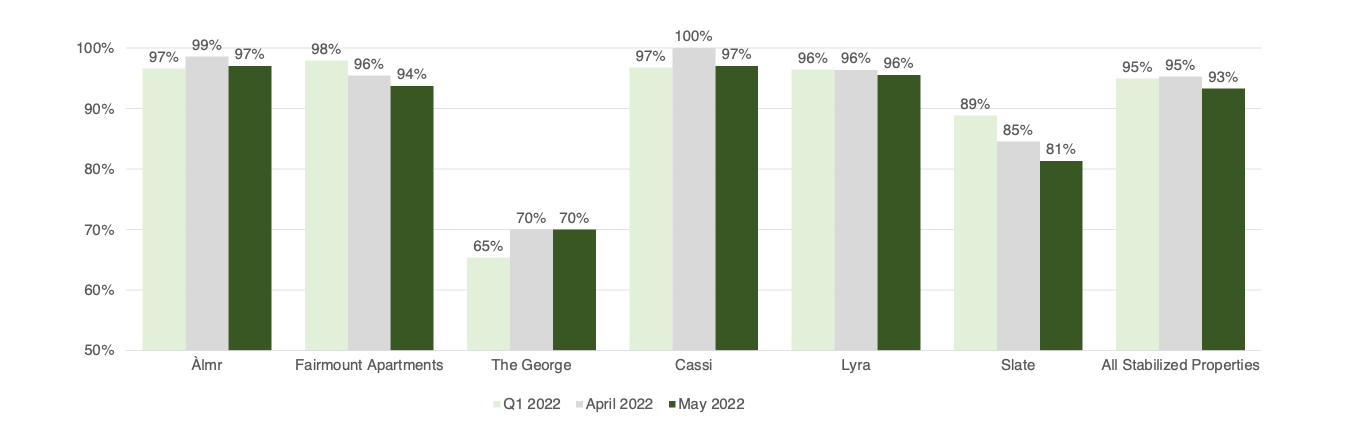

The table below shows the percent of units leased at individual properties and portfolio-wide, across all stabilized properties.

PErCENT OF UNITS LEASED - STABILIZED RESIDENTIAL PROPERTIES

Across our residential portfolio, the percent of units leased averaged 97% in May - up 1% from April and 2% from Q1 2022. At individual properties, the percent of units leased in May ranged from a low of 70% at The George, where leasing was temporarily impacted by building repairs that wrapped up at the end of April, to as high as 100% at Àlmr and Cassi. At Slate, as noted in the above discussion on rent growth from new leases and renewals, leasing 2-bedrooms units continues to be a challenge. To support leasing at Slate, we are offering a concession of one month free rent for new leases. Additionally, our Operations Team staged one of the vacant units and had it professionally photographed in May. In June, we will use the new photos of the model unit to refresh Slate’s digital marketing campaign.

To show off The George’s freshly repaired and sparking building facade, windows and courtyard, we have staged a model unit that will be professionally photographed in the first week of June. We will use the fresh images to launch a new Apartments.com campaign to market vacant units that were taken off line during repairs.

The table below shows average residential occupancy rates for individual properties, as well as the portfolio-wide average occupancy rate across all stabilized properties.

AVERAGE OCCUPANCY - STABILIZED RESIDENTIAL PROPERTIES

The portfolio-wide average occupancy rate was 93% in May, down from 95% in April and Q1 2022. As noted above, most of this decline in occupancy is attributed to challenges leasing vacant units at Slate. However, with the exception of the George, average occupancy is down across the board. This is due, in part, to the seasonal uptick in leasing activity and turnover that occurs each year from May through September. Recently, we are seeing more lease breaks. Up until the past two months, a new home purchase was one of the most common reasons for a lease-break. However, coinciding with the recent run up in mortgage interest rates, which is taking a bit of the edge off what has been a very hot housing market and has forced some would-be homebuyers to the sidelines, our Operations Team has observed a stark decline in the number of residents breaking leases due to a home purchase. Now, the most common reasons reported for lease-breaks include relocating for work or moving in with a partner to reduce housing costs in the current inflationary environment, in which rents, and the costs of most goods and services are rising. As rent assistance that was widely available during the first two years of the pandemic dries up and more workers are returning to the office, housing preferences and choices are shifting. On the plus side, lease-breaks provide an opportunity for us to increase rents substantially. In particular, at Cassi and Lyra—properties that were in their lease-up phase during the pandemic—we have been able to realize significant rent increases. For example, at the end of May, we signed a new lease at Lyra that rented for 35% more than the lease rate of the prior renter.