UD+P News: Winter 2023

2022 TAX REPORTING UPDATE

Our accounting team is progressing with the preparation of 2022 tax reporting documents as the April 15th filing deadline approaches. The estimated delivery date for Schedule K-1 tax documents for all UD+P funds is March 30. If any delays are anticipated, we will provide advance notice.

If you have relocated in the past year, please login to your investor portal and update your address in the “settings” tab or contact us directly with current information.

As a reminder, the Oregon Department of Revenue (ODR) requires pass-through entities to obtain a nonresident affidavit from nonresident owners if total Oregon-source distributive income is projected to exceed $1,000 during the tax year. We will be contacting out-of-state investors to obtain required nonresident affidavits via electronic signature.

If you have questions about 2022 taxes, please contact Investor Communications Manager, Tina McNerthney, by email or by phone at (503) 318-6588.

PROPERTY UPDATES

HOTEL GRAND STARK - PORTLAND, OR

Central Eastside

In November, after a year of negotiations, we executed a lease with a reputable, Portland-based Food and Beverage (F&B) operator at Hotel Grand Stark. Since the closure of Grand Stark Deli in March, onsite F&B options have been limited. Bar Chamberlain is currently open four nights a week—Thursday through Sunday. Our new operator will bring a full-service, Italian concept, restaurant and bar to the hotel, with a planned opening in March 2023. For the first 90 days, the restaurant will offer dinner service and the bar will operate on a regular schedule. After 90 days, the restaurant will add breakfast and lunch service. We are excited about this new partnership, and we anticipate that having room service and onsite dining and drinking options available to hotel guests, as well as a full-service restaurant and bar open to the general public, will have a positive impact on the hotel’s performance. We will share additional details about this new venture as soon as our hotel operator, Pali Group, and our new F&B operator are ready to make a public announcement.

In the news

SFGate.com recognized Hotel Grand Stark as one of Portland's Top 5 hotels for guests on any budget.

Centrl Office Sacramento…

In February, District Office tenant Revel Indoor Cycling was featured in Portland Monthly’s 10 Great Group Fitness Classes in Portland.

construction Progress updates

LUELLA - SACRAMENTO, CA

MIDTOWN

Luella, our 51-unit multifamily project underway in Sacramento, is really beginning to take shape. In spite of some challenging weather during the holidays and early January, our general contracting partner, Market One Builders, has made impressive progress. We will wrap up fourth floor framing by spring and delivery is on track for summer 2023. Check out some of our latest progress photos and a video of our construction crew installing Luella’s roof trusses in February.

OFFICE LEASING UPDATE

As shown in the table below, UD+P’s office portfolio is 85% leased. Overland Warehouse is listed for lease and for sale through our broker, Apex Real Estate Partners. Our team is working closely with the Old Town Community Association and local business owners to craft creative options around building tenancy. At District Office, office vacancies on the 4th and 5th floors are being marketed for lease through our broker, JLL. While office leasing continues to be a challenge, we are consistently receiving inquiries from prospective tenants interested in District Office—notably from architecture/design and professional services industry firms.

Office leasing summary

RETAIL LEASING UPDATE

UD+P’s retail portfolio is 74% leased. As shown below, we currently have vacancies at Slate, Lyra, District Office and 1201 J Street, which we are actively marketing through brokers and relationships our team has fostered with business associations and other community partners.

RETAIL LEASING SUMMARY

RESIDENTIAL LEASING UPDATE

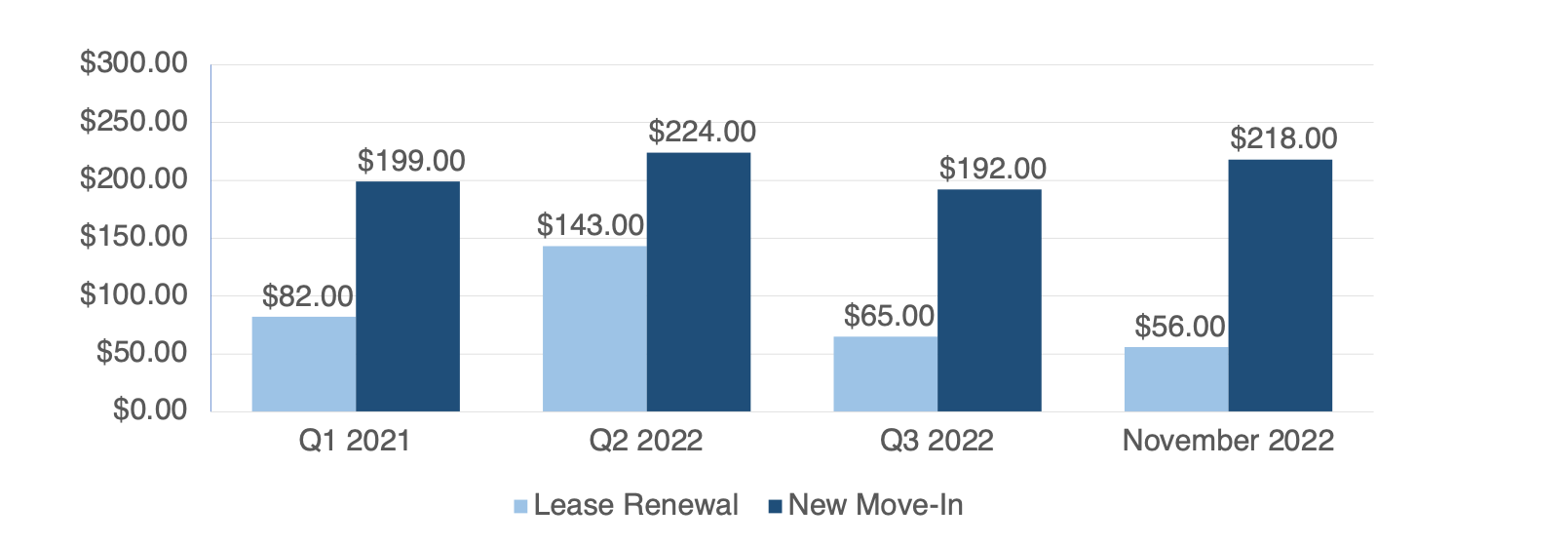

Historically, residential leasing activity slows down in the fourth quarter as the weather cools down and people’s focus turns to the holidays. In November, we received five rental applications and executed five new leases. As shown in the tables below, lease turnover (LTO) yielded average rent growth of 19.09% ($218) in November, up from 15.02% ($192) in Q3 2022. After a year of accelerated rent growth, rents are beginning to stabilize and rent increases are starting to taper off. Our Operations Team has budgeted for more modest, 3% rent increases in 2023 at all of our properties.

We executed seven lease renewals in November. These renewals yielded average rent growth of 4.88% ($56). This is in line with our general target of 4 to 6% gross rent increases on renewals.

Lease Turnover and Renewal - Average Rent Growth (%)

Lease Turnover and Renewal - Average Rent Growth ($)

The table below shows the percent of units leased at individual properties and portfolio-wide, across all stabilized residential properties, from Q1 2022 through November 2022.

PERCENT OF UNITS LEASED - STABILIZED RESIDENTIAL PROPERTIES

After holding steady at 95% since the start of 2022, the percent units leased across our portfolio dropped two percent in November to an average of 93%. Since summer, we have observed a notable uptick in move-out notices from residents living in studio apartments. At Fairmount and Cassi, properties with a higher proportion of studio units, the percent of units leased dropped to an average of 89% and 85% respectively in November. Based on correspondence with departing residents and market research, we have found that rising rents are driving more renters to move into a larger unit with a roommate or partner to reduce their rent burden and, simultaneously, gain more living space. Additionally, rising interest rates have cooled down the for sale housing market enough to give buyers some breathing room and lease breaks attributed to a new home purchase have increased during the past couple of months. Fairmount is also facing more direct competition from a new apartment community, The Kathryn Ann, that opened up across the street this year. In late November, we adjusted pricing for vacant studios at Fairmount. Additionally, we are offering a $500 gift card to qualified applicants who sign a new lease. We are optimistic that these measures will lead to new leases and lower vacancy in December and beyond.

Since the completion of building repairs earlier this year, The George has maintained 100% occupancy. Slate is another bright spot. After dropping to 88% in Q2, the percent of units leased increased to an average of 95% in Q3 and 96% in October and November. Our Operations Team’s success in enhancing Slate’s marketing campaign, identifying additional parking options for residents, and engaging with a local company that secures housing placements for out-of-area workers in Portland for contract work and short-term assignments, are factors that have contributed to Slate’s improved performance.

We have instituted several changes to leasing and operations protocols to strengthen the financial performance of our properties. Starting in October, we increased our security deposit to $1,000 across the board. We have also increased pet rents to $50/month per pet. As of October 1, the last of the pandemic-related emergency tenant protections and protocols have been lifted. We are now allowed to serve 72-hour eviction notices to renters who do not pay their rent by the required payment deadline. This has proven an effective tool for motivating residents to pay on time, and we have reduced our portfolio-wide accounts receivable to less than $300. Lastly, we have eliminated the option for residents to make a partial rent payment. The rent payment must be made in its entirety unless a resident has an approved payment arrangement with our Operations Teams.